Let’s be honest, insurance policies are complicated, but it’s something we all need and should have an understanding of. When it comes to farms, understanding our policies is key to properly insuring our operations. The more you know about farm insurance, the better choices you will make for your future. You don't have to know everything because that is what we are here for. However, it is helpful if you have a general understanding of the basics of farm insurance. Throughout this blog, we will focus on lots of different parts of farm insurance.There are 6 areas in which you should be concerned when it comes to your policy.

1. Causes of Loss Covered

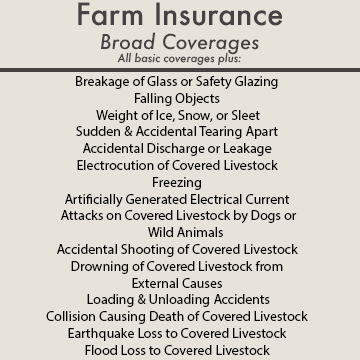

Look for the words basic, broad or special here. There is a big difference on how you are covered simply based on which one of these words is used.

Understand what is covered, how it is covered and what comes with the policy you have on your home and contents. Do you need to schedule out individual items like jewelry or guns? Do you need identity theft? Have you remodeled your house and need to increase your house coverage? These are all things you should look for in your home and contents coverage piece of your farm policy.

3. Farm Personal Property Coverage

What is farm personal property? Anything you use in the farm operation that is not a structure. Your machinery, tools, grain, feed, seed, chemicals, livestock, etc. Look and see what coverage you have and then ask, is this enough. Do you need peak season coverage for your grain, seed or chemicals? Do you know what peak season is? We can help explain all of that!

4. Farm Structures

5. Farm Liability Protection

We go into further detail on this in one of other blogs. But what we want you to look for now is do you have enough protection? Are all the locations you own, rent or farm listed on your policy for liability protection? Are you covering all the exposure in your operation? For example are you selling any products, hosting any events, doing custom farming?

6. Supplemental Coverage Options

Last but not least are the supplemental coverage options sometimes people never even think about. What are these? Things like an umbrella policy or a business auto policy. Maybe a general liability policy to extend into a commercial operation like selling cuts of beef or pork? Do you need anything supplemental to your farm policy?

At Paul Hall Insurance we are happy to take a look at your policy and help answer questions or concerns that you may have. Regardless of if you are a client or not we are happy to answer questions and review your policy because that is what we are here for. We understand farms and all of the risks that go into operations. Finding gaps in your coverage is the first step in protecting yourself. Just give us a call and we will help make sure your operation is covered for the present and for the future of your farm.